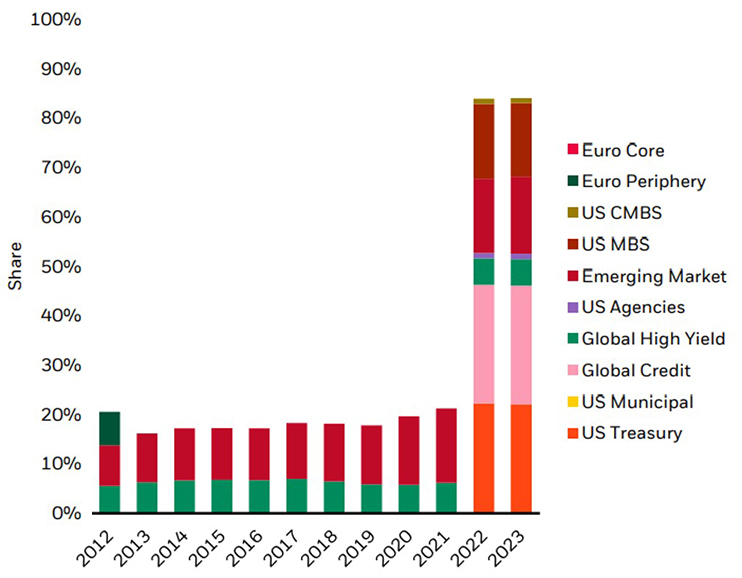

Over the last ten years income investors have been challenged by historically low yields across the fixed income sector. This pushed money further out on the risk spectrum in an effort to boost yield. What we see today is an unprecedented economic cycle fueled by the pandemic and related policy response that has rapidly impacted the universe of yield. At present, nearly 90% of fixed income markets yield above 4% compared to less than a quarter that did so at start of 2022.

Fixed Income Assets Yielding Over 4%, 2012 – YTD 2023

Source: Blackrock Investment Institute, Refinitiv, 2/28/2023. The bars show market capitalization weights of assets with an average annual yield over 4% in a select universe that represents about 70% of the Bloomberg Multiverse Bond Index. US Treasury represented by the Bloomberg US Treasury index. Euro core is based on the Bloomberg French and German government indexes. US Agencies represented by Bloomberg US Aggregate Agencies index. US Municipal represented by Bloomberg Municipal Bond index. Euro periphery is an average of the Bloomberg Aggregate Corporate index. US CMBS represented by the Bloomberg Investment Grade CMBS index. Emerging Market combines the Bloomberg EM hard and local currency debt indexes. Global High Yield represented by the Bloomberg Global High Yield index. The indexes are unmanaged, do not reflect fees or expenses (which would lower the return), and are not available for direct investment.

While holding fixed income investments during this major shift would have been painful, the good news is that yields across the fixed income universe have reached levels that should provide decent protection against further rises in rates.

The Donoghue Forlines team believes there are many opportunities for income across all asset classes and we have a diverse suite of strategies to help clients navigate this new and exciting environment.

Donoghue Forlines can help you rethink the role of income in your portfolio.

Opportunities for Income

Traditional Fixed Income

Donoghue Forlines Risk Managed Income Fund (FLOTX)

- Seeks high current income and preservation of capital during market declines.

- Invests in fixed income instruments (Floating Rate & High Yield) with lower sensitivity to interest rate risk.

- Employs tactical overlays to attempt to potentially reduce significant market drawdowns, investing in near cash instruments.

Donoghue Forlines Tactical High Yield ETF (DFHY)

- Seeks high current income and preservation of capital during market declines.

- Aims to capture the majority of the upside and more importantly avoid the majority of the downside of the high yield asset class during a full credit market cycle.

- Utilizes proprietary defensive “Tactical” indicators to attempt to mitigate downside volatility and preserve capital by shifting primarily towards intermediate term treasury exposure during market declines.

Equity Income

Donoghue Forlines Yield Enhanced Real Asset ETF (DFRA)

- Seeks to provide diversification, a hedge to inflation, and quality income.

- Aims to capture better risk-adjusted return than broad market equities in periods of positive inflation surprise.

- Utilizes proprietary screens to generate a higher dividend yield than broad market equities and the market-cap weighted real asset equities universe, with the potential of continuous dividend payments over the long term.

Donoghue Forlines Dividend Fund (PWDIX)

- Seeks high current dividend income and preservation of capital during market declines by investing in quality stocks exhibiting high yields.

- Invests in a diversified mix of sectors to reduce volatility.

- Employs tactical overlays to attempt to potentially reduce significant market drawdowns.

Multi-Asset Income

Donoghue Forlines Tactical Income Fund (PWRIX)

- Seeks high current income and preservation of capital during market declines.

- Invests in ETFs across asset classes, primarily fixed income and to a lesser extent equities and alternatives.

- Tactically manages risk and opportunity with a long term global macroeconomic view.

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate. Use of products, materials and services available through Donoghue Forlines may be subject to approval by your home office. All of the products or services described may not be available to you. Additional information on each strategy may be obtained by contacting the Donoghue Forlines team directly or by visiting www.DonoghueForlines.com.

Donoghue Forlines ETFs

Investing involves risk.

Principal loss is possible. Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the statutory and summary prospectuses, a copy of which may be obtained by visiting the Fund’s website at www.donohueforlinesetfs.com. Please read the prospectus carefully before you invest. The Donoghue Forlines ETFs are distributed by Quasar Distributors, LLC, member FINRA/SIPC. Donoghue Forlines LLC is not affiliated with Quasar Distributors, LLC.

There is no guarantee that DFHY or DFRA will achieve their investment objectives . Investing involves risk, including the possible loss of principal. Because the Fund is an ETF (rather than a mutual fund), shares are bought and sold at market price (not NAV), may trade at a discount or premium to NAV, and are not individually redeemable. Owners of the shares may acquire those shares from the Fund and tender those shares for redemption to the Fund in Creation Unit aggregations only, consisting of 25,000 shares. Brokerage commissions will reduce returns. Investments in the Fund include risks associated with small-and mid-cap securities, which involve limited liquidity and greater volatility than large-cap securities. Because the Fund invests in ETFs, an investor will indirectly bear the principal risks of the underlying funds, including illiquidity, and an investment in the Fund will entail more costs and expenses than a direct investment in the Underlying ETFs. Passive funds that seek to track an index may hold the component securities of the underlying index regardless of the current or projected performance of a specific security or relevant market as a whole, which could cause the Fund returns to be lower than if the Fund employed an active strategy. The performance of the Fund may diverge from that of its Index. Downside Protecion Model Risk. Neither the Adviser nor the Sub Adviser can offer assurances that the downside protection model employed by the Underlying Index methodology will achieve its intended results, or that downside protection will be provided during periods of time when the Equity Portfolio is declining or during any period of time deemed to be a bear market. Investment in a fund that utilizes a downside protection model that seeks to minimize risk only during certain prolonged bear market environments may not be appropriate for every investor seeking a particular risk profile. The Fund’s investments in derivatives may pose risks in addition to and greater than those associated with investing directly in the underlying assets, including counterparty, leverage and liquidity risks. The Fund may participate in futures markets, which are highly volatile. The Fund’s investments in derivatives may pose risks in addition to and greater than those associated with investing directly in the underlying assets, including counterparty, leverage and liquidity risks. Active and frequent trading of portfolio securities may result in increased transaction costs to the Fund and may also result in higher taxes if Shares are held in a taxable account. REITs Risk. A REIT is a company that pools investor funds to invest primarily in income producing real estate or real estate related loans or interests. The Fund may be subject to certain risks associated with direct investments in REITs. MLP Risk. An MLP is a publicly traded partnerships primarily engaged in the transportation, storage, processing, refining, marketing, exploration, production, and mining of minerals and natural resources. MLP common units, like other equity securities, can be affected by macroeconomic and other factors affecting the stock market in general.

The Donoghue Forlines Tactical High Yield ETF seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FCF Tactical High Yield Index.

The Donoghue Forlines Yield Enhanced Real Asset ETF seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FCF Yield Enhanced Real Asset Index which is designed to track the investment results of a rules-based strategy that aims to provide exposure to “real assets” equities based on the Adviser’s proprietary research.

Donoghue Forlines Funds Important Risk Information Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund. This and other information about the Fund is contained in the prospectus and should be read carefully before investing. The prospectus can be obtained by visiting the Fund’s website at www.donohueforlinesfunds.com or by calling toll free 1-877-779-7462. The Donoghue Forlines Funds are distributed by Northern Lights Distributors, LLC, member FINRA/SIPC. Donoghue Forlines LLC is not affiliated with Northern Lights Distributors, LLC.

As with all mutual funds, there is the risk that you could lose money through your investment in the Fund. The net asset value of the Fund will fluctuate based on changes in the value of the equity securities in which it invests. Hedging strategie s may not perform as anticipated by the adviser and the Fund coul d suffer losses by hedging with underlying money market funds if stock prices do not decline. If money market funds are utilized, such Underlying Funds are subject to investment advisory and other expenses, which will be indirectly paid by t he Fund. As a result, your cost of investing in the Fund will b e higher than the cost of investing directly in Underlying Funds and may be higher than other mutual funds that do not invest in Underlying Funds.

The primary investment objective of the Donoghue Forlines Tacti cal Income Fund is total return from income and capital appreciation with capital preservation as a secondary objective .

The primary investment objective of the Donoghue Forlines Divid end Fund is total return from dividend income and capital appreciation with capital preservation as a secondary objective .

The Fund tracks a proprietary rules based index. The primary investment objective of the Donoghue Forlines Risk Managed Income Fund is total return from income and capital appreciation with capital preservation as a secondary objective. The Fund tracks a proprietary rules based model.